Mark Your Calendar

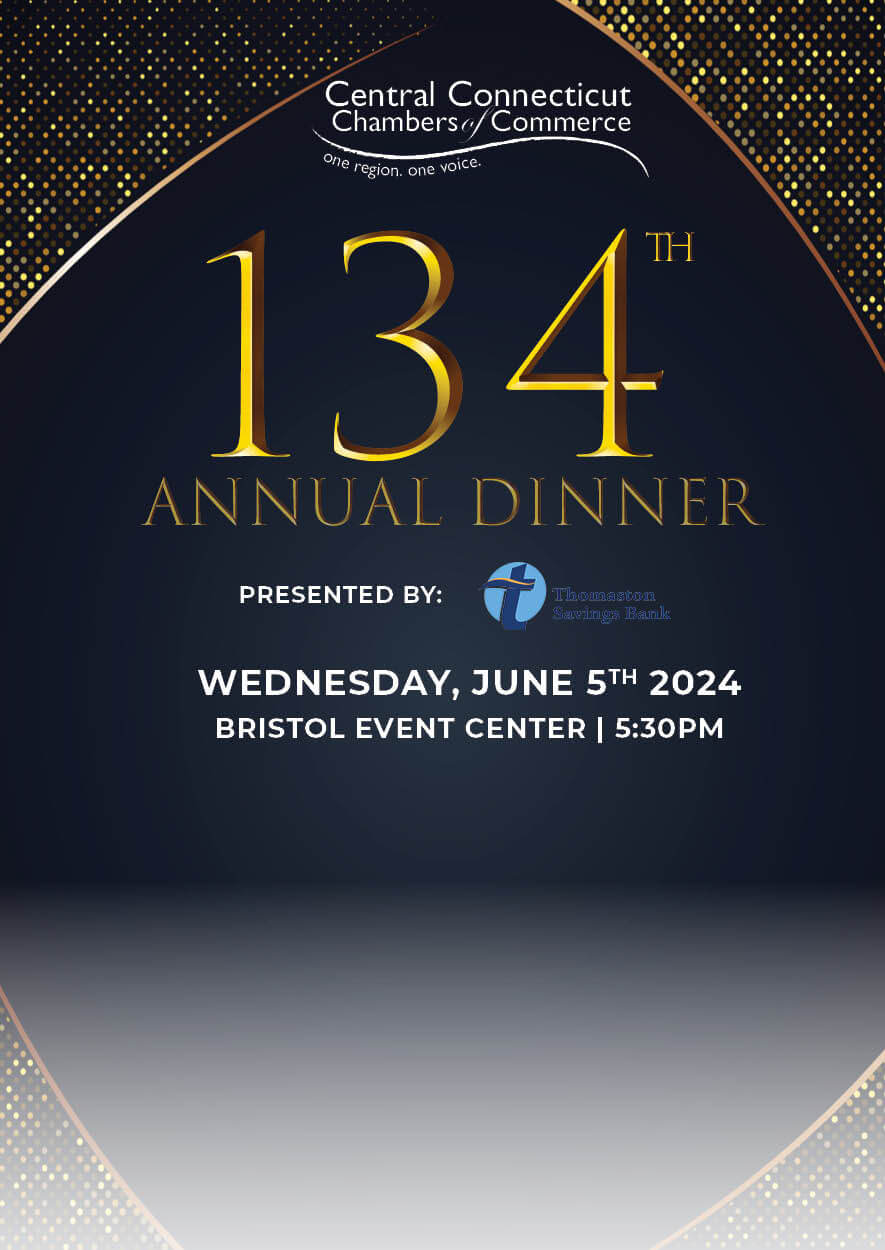

The Central CT Chambers of Commerce proudly puts on over 100 events each year, focused on providing memorable opportunities to connect with businesses, community leaders and elected officials. Our events open networking opportunities that you won’t find anywhere else.

The Jolt - Second Cup Podcast

The Jolt, brought to you by the Central Connecticut Chambers of Commerce, brings you closer to the those who make the area business scene thrive, who they are, issues they face and the great stories they have to tell.

Explore the Region

Thank You to Our Sponsors!

Adams Samartino

AG

Barnes

Bristol Connecticut

Bristol Health

collinsville bank

COVANTA

D'amato

go net speed

Hospital of Central-Connecticut

ion bank

the jackson laboratory

NBT Bank

thomaston savings bank

torrington savings bank

uconn huskies

uconn health

webster bank

United Way